reit dividend tax rate 2021

DDMPR The real estate investment trust of Double Dragon Inc. The REIT has an impressive growth track record as its AFFO per share has soared from 067 in 2017 to 555 in 2021 and an expected AFFO per share tally of 800 in 2022.

Dividend Tax Rates For 2021 And 2022 Personal Capital

Founded by Edgar Sia II.

. DDMP REIT Inc. During 2021 taxable dividends for New Residentials common stock CUSIP 64828T201 were approximately 050014 per share. The Dividend Withholding Tax Rates by Country for 2021 has been published by SP Global.

April 20 2021 Four is the new big number in Piscataway. 2 days agoFederal Realty Investment Trust holds the REIT record for annual dividend increases of 55 years and counting. STAG Industrial STAG STAG Industrial STAG invests in industrial-use properties mostly.

An alternative sales tax rate of 6625 applies in the tax region Middlesex. In order to maintain this tax status ARMOUR is. Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to the story than that.

As of July 2021 its annual dividend was 228 for a yield of 586. ARMOUR has elected to be taxed as a real estate investment trust REIT for US. This simple one-pager shows the updated withholding tax rates for each country.

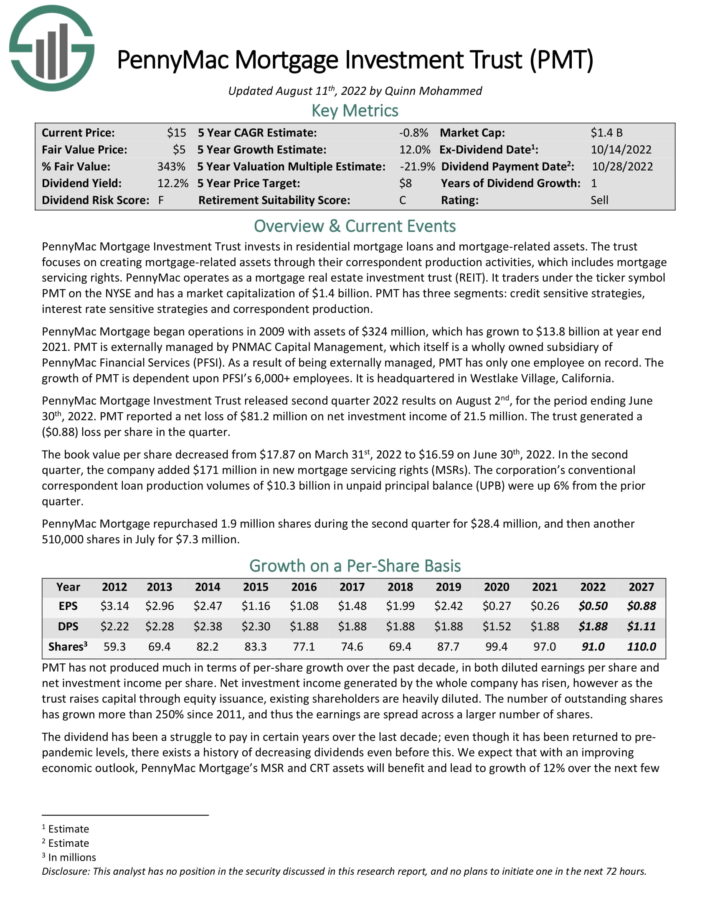

15 tax rate if shareholder. Jamaica and no more than 25 of the REITs income consists of dividends and interest. The REIT must show its 2022 tax year on the 2021 Form 1120-REIT and take into account any tax law changes that are effective for tax years beginning after December 31 2021.

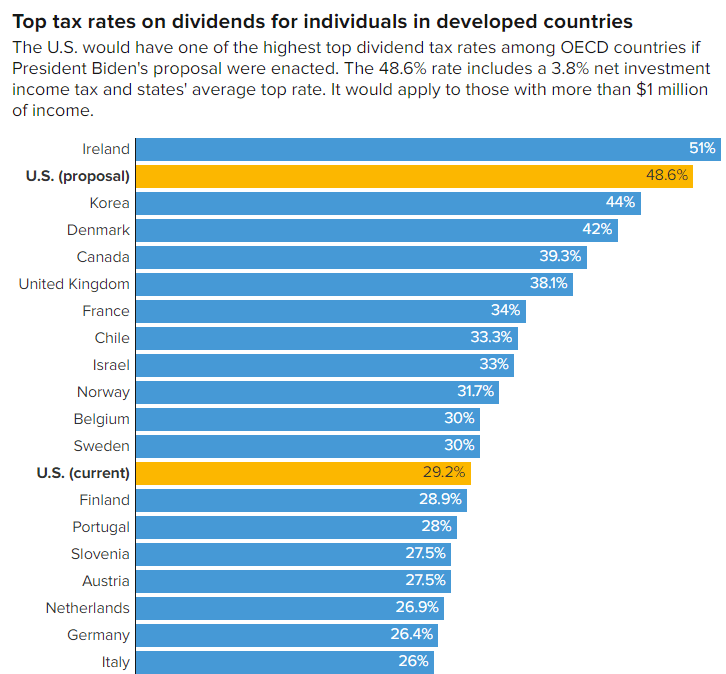

It recently increased its quarterly dividend from 107 to 108 and. PID dividends are normally paid after deduction of withholding tax at the basic rate of income tax 20 which the REIT pays to HMRC on behalf of the. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income.

We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. ARR and ARR-PRC ARMOUR or the Company today announced the. VERO BEACH Florida Nov.

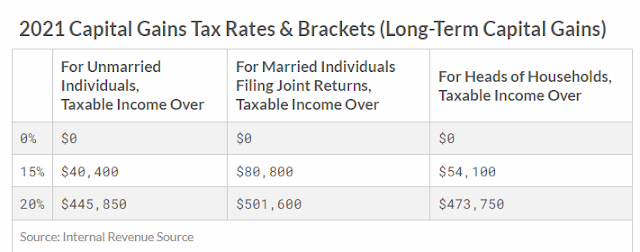

Since a composite return is a combination of various individuals various rates cannot be assessed. Qualified dividends get special tax treatment and are taxed at the same rates as long-term capital gains between 0 and 20. Piscataway Township hits a four-year stride with a 128 percent lower municipal tax rate.

Therefore the composite return Form NJ-1080C uses the highest tax. This provision qualified business income effectively lowers the federal tax rate on ordinary REIT dividends from 37 to 296 for a taxpayer in the highest bracket. 750 Series A Fixed-to-Floating Rate Cumulative.

It debuted in the Philippine Stock Exchange on March 23 2021 with. 30 tax rate if shareholder owns 25 or more of the REITs stock. Ordinary dividends are taxed at ordinary income.

Federal income tax purposes. We will mail checks to qualified applicants as. 29 2021 GLOBE NEWSWIRE - ARMOUR Residential REIT Inc.

The Piscataway New Jersey sales tax rate of 6625 applies to the following two zip codes.

The High Yield Potential From Reit Dividends Considering Taxes And Safety

10 Super High Dividend Reits With Yields Up To 24 3

How Dividend Reinvestments Are Taxed

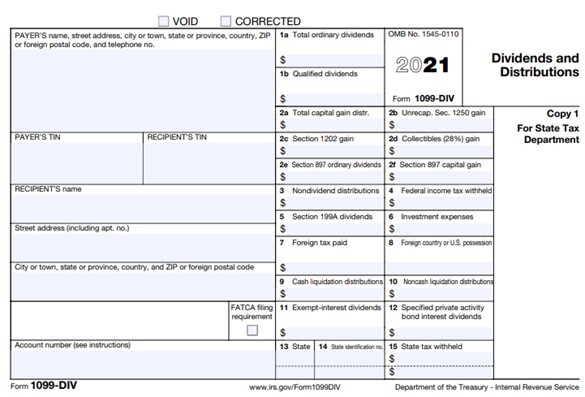

Reit Tax Advantages Demystifying Your 1099 Div

Reit Dividends And Distributions How Do They Work

How Is Income From Invits And Reits Taxed Capitalmind Better Investing

Spirit Realty Capital Inc Announces 2021 Dividend Tax Allocation Business Wire

Understanding How Reits Are Taxed

Crucial Questions For Reit Investors Wealth Management

Reit Dividends Wide Moat Research

Reit Dividend Hikes Bid For Bonds Sell Off Deepens

Section 199a Qbi Deductions For Reits Vs Direct Real Estate

Biden S Tax Proposal Impact On Stocks And How To Use Reits For Tax Advantages Seeking Alpha

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Multifamily Reit Dividends Vs Equitymultiple Investments

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof

Understanding How Reits Are Taxed

21 Reit Dividends I Love And Hate For 2021 Nasdaq

Dividends Provide A Tax Efficient Form Of Income Dividend Growth Investor